By Micah Jonah

January 21, 2026

Venezuela has received 300 million dollars from recent oil sales, marking the first inflow of funds from the newly announced 50 million barrel oil supply agreement between Caracas and the United States, interim President Delcy Rodriguez confirmed on Tuesday.

Speaking at a public event in Caracas, Rodriguez said the funds form part of an expected 500 million dollars in oil revenue and will be deployed through the national exchange market with support from local banks and the central bank. The goal, she explained, is to strengthen market stability, protect workers purchasing power across the country.

“These first funds will be used through the exchange market in Venezuela, by national banks and the central bank, to consolidate and stabilize the market and protect the incomes and purchasing power of our workers,” Rodriguez said.

Shipping data indicates that while the oil volume involved in the deal has not yet been fully exported, financial arrangements are already producing results for the domestic economy. Earlier reports indicated that four Venezuelan banks had been notified they would receive portions of the deposited oil revenues held in an account in Qatar, allowing them to supply foreign exchange to companies importing essential production materials.

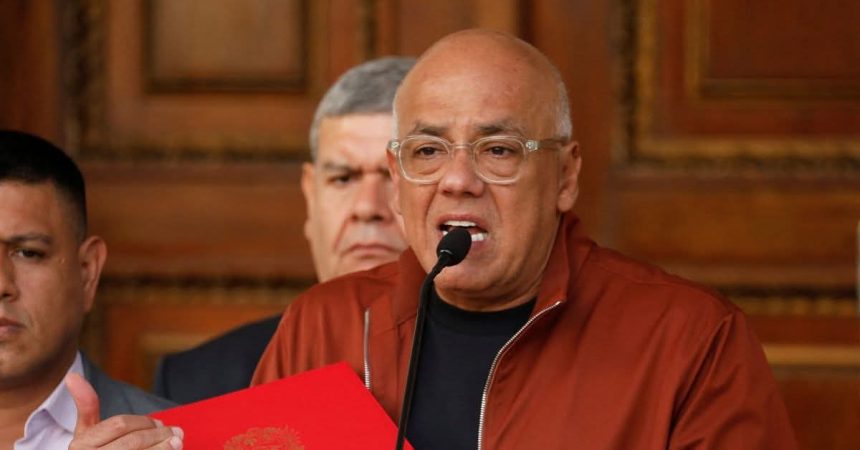

Meanwhile, lawmakers are preparing to debate reforms to the nation hydrocarbons law aimed at attracting new investment into the energy sector. National Assembly President, Jorge Rodriguez stated that the proposed reforms will build on partnership models introduced in recent years, allowing greater flexibility while maintaining state participation through the national oil company.

He described the partnership framework as a fundamental component of the legal reforms and said it would encourage productive collaboration with foreign investors while supporting national development goals.

The government has expressed confidence that the revised legal structure will enhance output, strengthen revenue flow, create long term growth opportunities for the energy sector, which remains central to the country economic recovery strategy.

Officials say the combination of renewed oil revenue inflows and legal reforms reflects a broader effort to stabilize the economy, strengthen institutions and restore confidence in national financial systems.