RismadarVoice Media, December 2, 2025

Akwa Ibom Internal Revenue Service (AKIRS) has outlined major implications of the new Nigerian Tax Reform Acts recently signed into law by President Bola Ahmed Tinubu.

The reforms, which come into effect on January 1, 2026, are aimed at overhauling the country’s tax administration framework, eliminating multiple taxation and improving revenue generation across all tiers of government.

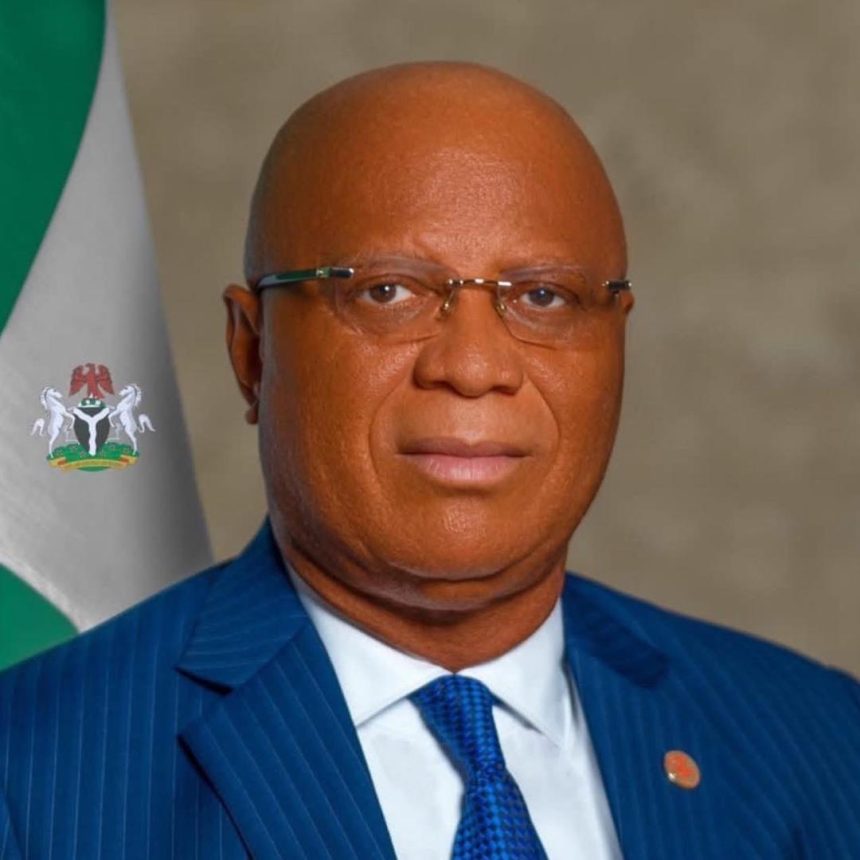

Addressing journalists in Uyo, Executive Chairman of AKIRS, Sir Okon Okon, said the reforms became necessary to replace what he described as “archaic and stale” tax laws that no longer support efficient revenue administration.

According to him, the new regime targets several long-standing challenges, including the multiplicity of taxes and levies, heavy tax burdens on low-income earners and small businesses, uneven enforcement across jurisdictions, and inefficient manual administration systems.

Sir Okon disclosed that President Tinubu signed four major tax bills into law on June 26, 2025, collectively referred to as the Nigerian Tax Reform Acts.

These laws, he said, will introduce a simplified, unified, and technology-driven tax system nationwide.

Sir Okon explained that the reforms will also address fiscal imbalance, improve transparency, harmonize tax administration, eliminate nuisance taxes, and introduce a single National Tax Identification Number (Tax ID) for all taxpayers.

Highlighting the new Acts, the AKIRS Chairman announced that the Joint Revenue Board (JRB) Establishment Act 2025 has replaced the former Joint Tax Board (JTB).

The new JRB will coordinate tax administration across federal, state, and local governments, and oversee nationwide tax programmes, including Data4Tax and digital tax systems.

Similarly, the Nigeria Revenue Service (NRS) Establishment Act 2025 replaces the Federal Inland Revenue Service (FIRS).

The NRS, he said, will “serve the Federation, not just the Federal Government,” and is empowered to collect revenue for states when so mandated.

Sir Okon also highlighted the Nigeria Tax Administration Act (NTAA) 2025, which provides a new legal framework for State Revenue Authorities and establishes both national and regional Tax Ombud offices.

The Act also reintroduces Tax Appeal Tribunals across the country.

He announced that the broader Nigeria Tax Act (NTA) 2025 consolidates more than 25 tax laws into a single document and repeals or amends several existing laws, including those governing VAT, Stamp Duty, Capital Gains Tax, TETFund, Customs & Excise, and FERMA.

Sir Okon further listed over 50 tax exemptions and reliefs under the new regime aimed at reducing the burden on low-income earners.

These include exemptions for minimum wage earners, individuals earning up to ₦1.2 million annually, lower PAYE rates for incomes up to ₦20 million, tax-exempt gifts, pension and NHIS contributions, and interest on loans for owner-occupied homes.

Other reliefs include rent allowance of up to ₦500,000 or 20% of annual rent, exemption of pension funds and retirement benefits under the Pension Reform Act, and compensation for loss of employment up to ₦50 million.

Also at the briefing was Commissioner for Finance, Mr. Emem Bob, urged Nigerians to embrace the new tax laws, describing them as reforms designed to benefit the poor and strengthen the economy.